CTA Form PR FAQs

No. Registered CTAs that do not direct any commodity interest accounts are not required to file the Form PR with the CFTC. See CFTC Staff Letter No. 15-47 for details.

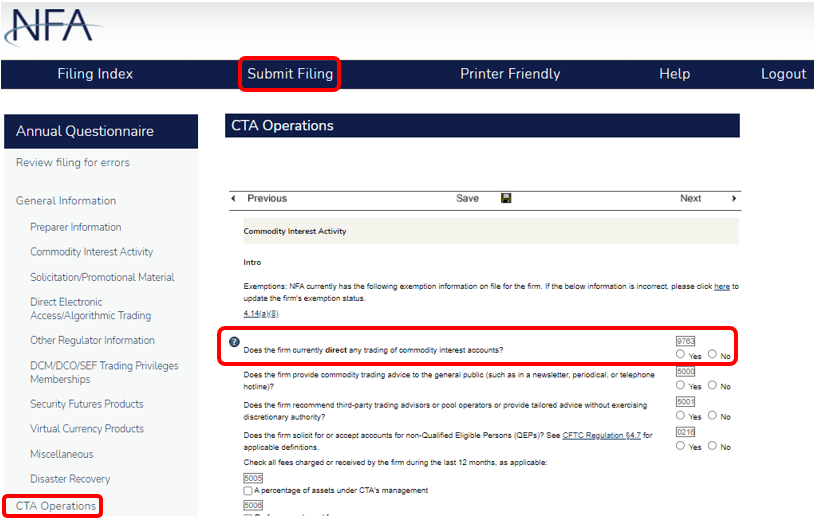

No. NFA Member CTAs that do not direct commodity interest accounts are not required to file the Form PR with NFA or the CFTC. However, the CTA must notify NFA by having an authorized user log into the Member Questionnaire, responding "No" to the question "Does the firm currently direct any trading of commodity interest accounts?" in the CTA Operations section of the Member Questionnaire, and clicking "Submit Filing". Doing so will update your status and the firm will not be required to file a quarterly PR.

CTAs that subsequently begin directing trading of commodity interest accounts (excluding any pools that the CTA operates as a registered or exempt CPO) must immediately notify NFA of this change by responding "Yes" to the question "Does the firm currently direct any trading of commodity interest accounts?" in the CTA Operations section of the Member Questionnaire. Failure to do so will result in the firm not receiving important notifications regarding its filing requirements.

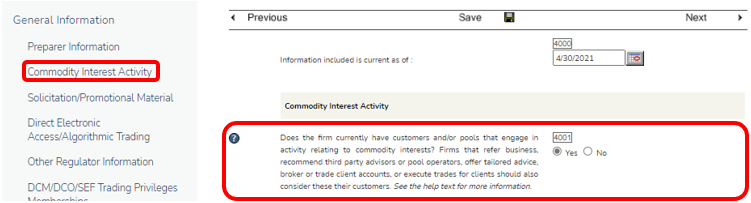

Note: If this question does not appear in the CTA Operations section, then ensure you have selected "Yes" to the question below in the Commodity Interest Activity section under General Information:

No. CFTC Regulation 4.27 no longer requires CTAs that solely direct trading of pools for which the firm operates as a registered or exempt CPO to file the Form PR.

In order to ensure that NFA's records are accurate for determining Form PR filing requirements, any CTA that intends to take advantage of this relief must have an authorized user log into the Member Questionnaire, respond "No" to the question "Does the firm currently direct any trading of commodity interest accounts?" in the CTA operations section, and click "Submit Filing".

CTAs that subsequently begin directing trading of commodity interest accounts (excluding any pools that the CTA operates as a registered or exempt CPO) must immediately notify NFA of this change by responding "Yes" to the question "Does the firm currently direct any trading of commodity interest accounts?" in the CTA Operations section of the Member Questionnaire. Failure to do so will result in the firm not receiving important notifications regarding its filing requirements.

Note: If this question does not appear in the CTA Operations section, then ensure you have selected "Yes" to the question below in the Commodity Interest Activity section under General Information:

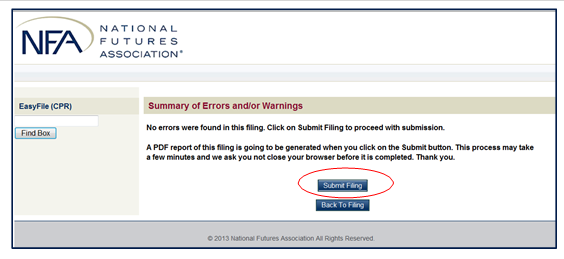

You must first click "Review filing for errors" on the left side of any screen in the filing. If your filing is free of errors, you will get a “Submit Filing” button located at the bottom of the Summary of Error and/or Warnings page.

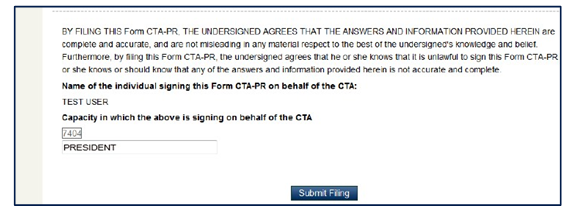

Once you submit the filing, you will be asked to complete the oath by entering the capacity in which you are signing on behalf of the CTA.

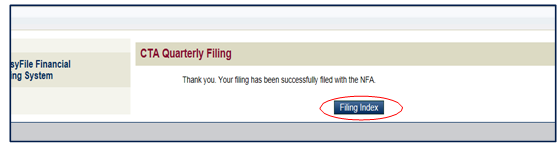

After completing the oath, you will again click on the “Submit Filing” button and you will receive a confirmation that the filing has been submitted. To ensure the filing has been received, click on the “Filing Index” button at the bottom of the page.

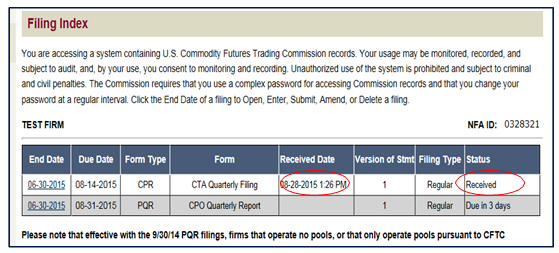

On the Filing Index page, a date in the “Received Date” column and a status of “Received” will indicate that the filing has been successfully submitted.

The Form PR must be submitted by a representative duly authorized to bind the CTA. This representative will be asked to electronically sign an oath or affirmation prior to submission.

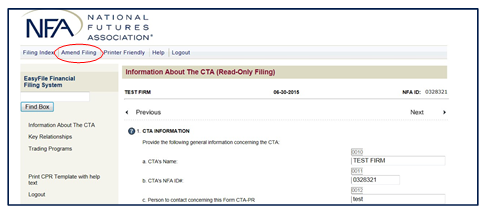

From the Filing Index page, click on the specific filing you wish to amend. The system will take you to the “Information About the CTA” page of the specific filing you wish to amend. At the top of the page there is a blue bar that includes a link to "Amend Filing".

Once you click on "Amend Filing", a text box will open in which you must include a brief description of the reason for the amendment. Click “Next” when finished. Now you will be able to amend the filing. Once the filing has been amended, you must click on “Submit Filing” to complete the process.

No.

If you are having technical issues, send an email to CTAPRSupport@nfa.futures.org with the following information: firm name, NFA ID, and a detailed description of the problem. An NFA representative will respond to your request within one to two business days.

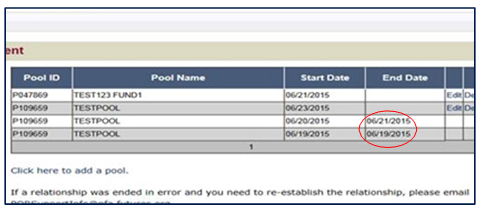

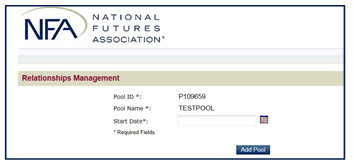

You may be receiving an error message because you are attempting to re- establish the pool relationship with a start date that is prior to the end date that you previously entered when you terminated the pool relationship. The screen to add the relationship should also indicate the end date that was previously entered.

To re-establish the pool relationship and have it appear on the current filing, add a start date within the current reporting period that is not prior to the previously entered end date.

The CPO Form PQR and Form PR are linked through relationships. Therefore, although you may have terminated the relationship with the pools, the respective CPO that operates those pools may have reported a trading manager relationship with your firm which may have re-established a relationship between your firm and the pools.

You can rectify this issue by re-entering an end date in the current reporting period. To alleviate the need to do this every filing, you may also want to contact the CPO to ensure that it is not incorrectly reporting this relationship.

This question is directed at carrying brokers that are registered as an FCM, FDM, and/or RFED that carry your client accounts or that you transact business with as of the reporting date. If your client accounts are solely transacting in swaps and the counterparty is a bank, exempt foreign firm, or swap firm that is provisionally registered, you will not be able to add the firm name unless the counterparty is a CFTC-registered FCM, FDM, or RFED. Leave this information blank and continue completing the filing. Upon submitting the filing, you will receive a warning message directing you to add a carrying broker. A firm can submit a filing with a warning, and the firm has the ability to submit a note if warnings exists.

After the carrying broker name is entered in the search box, a list of carrying brokers will be populated. You must then click “Select” on the left-hand side of the carrying broker’s name. This will take you to another screen that will display the carrying broker’s name and address. You will be asked to enter a start date for the relationship and then click “Add Relationship”. The carrying broker should now be added to Question 3 of the Form PR.

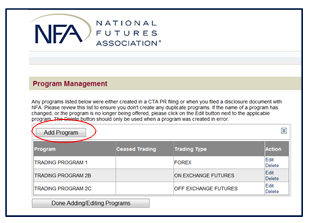

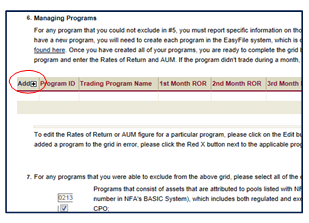

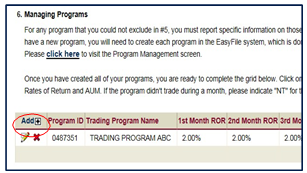

Adding a program in Question 6 is a two-step process.

First, click on the Add Program button in the Program Management screen and fill out the program information in the pop-up screen that displays.

Once the program has been created, you must click on the "Add" link at the left-hand corner of the grid in Question 6. Follow the prompts to add the Once added, it will populate in the grid in all future filings until you remove the program.

To remove a program from the grid, click on the red X at the top-left corner of the grid. A window will open confirming that you want to delete the program. Clicking “yes” will delete the program from the grid. To edit a program in the grid, click on the pencil. This will allow you to enter the rates of return and assets under management each quarter.

The Assets Directed by the CTA reported in Box 0030 include pool assets attributable to pools for which the CPO is exempt from registration under Regulation 4.13 (exempt pools) and pools for which the CPO is excluded from registration under Regulation 4.5. The assets attributable to these exempt and excluded pools are not included in the amount reported for total assets directed by the CTA in Box 0015. Pool assets attributable to commodity pools that you operate as a CPO and report on the CPO Form PQR should be excluded from the figures reported in both Box 0015 and Box 0030.

As the instructions indicate, the firm should provide a reasonable good-faith estimate when reporting the percentage breakdown of investments in Box 0025, Box 0026, Box 0027 and Box 0028. The breakdown of percentages should be based upon the figure reported in Box 0030.

This bullet point refers to certain investments products where collateral may not be posted as of the reporting date. For purposes of reporting in Question 8, you should report the collateral due but not yet posted in the appropriate investment category. For example, if the collateral is due for a swap transaction, the collateral should be reported in Box 0026 as if posted as of the reporting date.

If the CTA has entered into an agreement with its client(s) to trade account(s) based upon a nominal account size which includes notional funding, the notional funds that make up the nominal value in Box0030 should be reported in "Excess collateral/cash allocated for futures and swap trading" (Box 0027).

On the Form PR, CTAs are required to report two financial ratios: Current Assets/Current Liabilities (CA/CL) and Total Revenue/Total Expenses (TR/TE). These ratios provide information regarding the firm's financial condition such as liquidity and operating margin. Ratios must be calculated using the accrual basis of accounting and in accordance with generally accepted accounting principles.

For purposes of calculating CA/CL, Current Assets include cash, receivables or other assets that can be readily converted to cash within one year. Similarly, Current Liabilities are obligations that are reasonably expected to be paid within one year such as payroll, income tax and other expenses/accounts payable.

For purposes of calculating TR/TE, the ratio should reflect Total Revenue and Total Expenses for the 12 months prior to the reporting quarter end. Total Revenue must include gross income earned by the firm for its normal business activities such as management and incentive fees. Total Expenses must include costs incurred in a firm's efforts to generate revenue or the cost of doing business. Examples include salaries, rent, utilities, depreciation and bad debts.

Ratios may not be shown as a negative number. When calculating ratios, firms must take the absolute value of the respective balances. Further, it may be reasonable to report a ratio of 0 for example if a CTA had no reportable liabilities or expenses. There is no suggested ratio that a firm is recommended to maintain.